Medical Program Need-Based Grant

•An applicant must be a U.S. citizen, naturalized citizen of the United States, permanent resident, eligible non-citizen, or DACA to qualify for institutional or federal financial aid.

•The application for financial aid is not a factor in the decision for acceptance to Weill Cornell Medicine.

•When accepted, financial aid is awarded only on the basis of demonstrated need.

•Need is determined by an analysis of income and assets of students and their families. We do not offer merit-based scholarships.

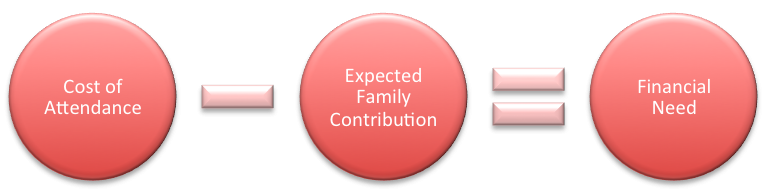

Financial need is determined based on the formula:

Cost of Attendance

•The Cost of Attendance includes "direct" and "indirect" costs.

•Direct costs are billable charges such as tuition, student fees, on-campus housing, health insurance.

•Indirect costs are non-billable expenses students may incur such as transportation, living expenses (food and housing), books, course materials, supplies and equipment, and personal items.

Expected Family Contribution

•Family contribution includes both the student and the parents’ ability to contribute.

•This usually includes both parents, even if they are separated or not married.

•If a student is married or has a domestic partner, information from the spouse/domestic partner is considered.

•The factors that affect overall family contribution include, but are not limited to, income, assets, family size, and the number of children in college seeking undergraduate degree.

•The Office of Financial Aid may adjust the expected family contribution based on documented unusual or unique family circumstances. Students are encouraged to contact the Office of Financial Aid regarding special circumstances. Visit financial aid appeal section for more details.

Financial Need

•A student's financial need is determined after deducting Expected Family Contribution from the total Cost of Attendance.

•Financial need is met up to 100 % grant funding as of the 2019-20 academic year.

To continue to be eligible for aid, students must be in good academic standing and making Satisfactory Academic Progress according to the Guidelines for Promotion and Graduation of the Medical College, printed annually in the Student Handbook.

We do not offer merit-based scholarships.